|

Setting up your taxes is a simple and fast

process. Magnet Commerce allows you to create your own custom

options according to your area's tax rules. It is possible

to set general rules for the countries you are shipping products

to as well as more specific ones referring to certain areas

or states of a country.

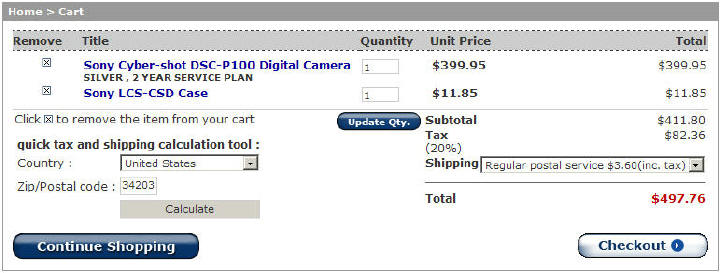

In order to do so, access the Taxes administration

panel from the "Setup > Taxes" tab:

| Figure:

Setup your Tax Options

by choosing "Setup > Taxes" in the Administration

Panel. |

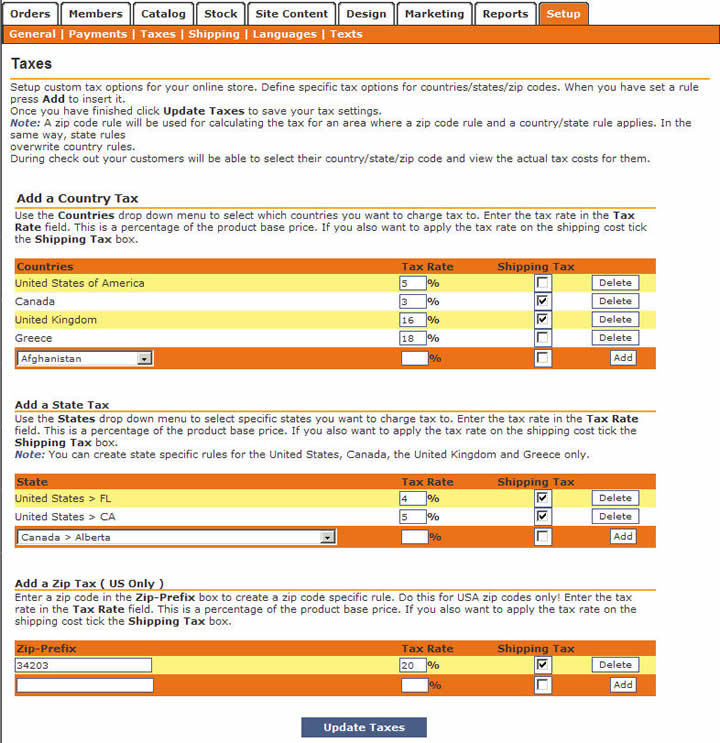

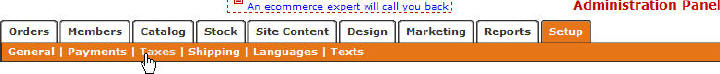

Editing the Tax Options menu.

The following form found in the Administration

Panel is used for adding Tax Options:

| Figure:

Adding Tax rules in

the Tax Options menu. |

The form is split into 3 categories, one for

adding tax rules per Country, another for adding rules per

State (which applies to Canada, Greece, the United Kingdom

and the United States) and a third one for adding rules using

Zip codes (which only applies to the US).

Add a Country Tax:

If you wish to add tax on your products depending

on the country you are shipping to, use the "Add a Country

Tax" form. Simply use the drop down menu in the "Countries"

field to choose the country you want to set tax for and then

define the tax amount in the "Tax Rate" box. If

you also wish to add tax on the shipping cost tick the "Tax

Shipping" box. Finally click on the "Add" button

to save the current rule. Remember there is always the option

of deleting a rule by use of the "Delete" button.

Add a State Tax:

Magnet Commerce also gives you the option of adding

state specific tax rules by use of the "Add a State Tax"

form. Choose the state your rule applies to from the "State"

drop down menu and then define the tax amount in the "Tax

Rate" box. If you also wish to add tax on the shipping

cost tick the "Tax Shipping" box. Once this is done

click on the "Add" button to save the current rule.

You can always delete a rule by using the "Delete"

button. Please note that you can apply state specific rules

for the following four countries: Canada, Greece, the United

Kingdom and the United States.

Add a Zip Tax:

A third option is to add area specific tax rules

by specifying the zip code of the area. In the "Add a

Zip Tax" form, type a zip code in the "Zip Prefix"

field and then define the tax amount in the "Tax Rate"

box. If you also wish to add tax on the shipping cost tick

the "Tax Shipping" box. Finally click on the "Add"

button to save the current rule. Remember there is always

the option of deleting a rule by use of the "Delete"

button. Please note that this can only be implemented for

shipping in the United States.

! Remember,

it is important that you click the "Add" button

after each rule is set or the rule will not be applied!

Once all the rules have been added, click the "Update

Setup" button to update the e-commerce storefront with

the current settings.

Tax options on the store front:

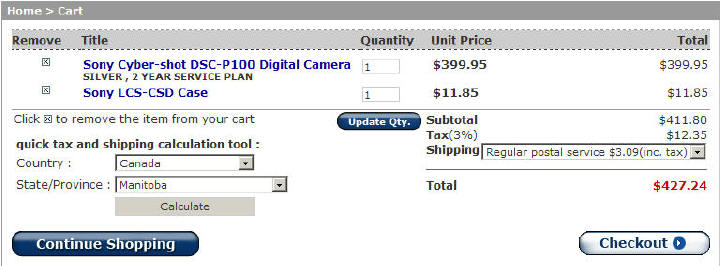

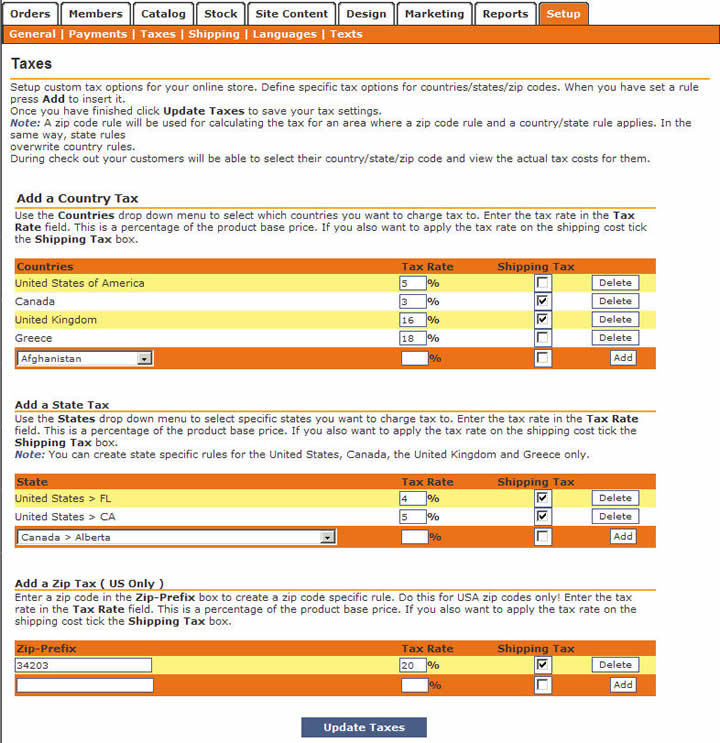

Lets now take a look at an e-commerce storefront

for which the previous tax rules have been set. By viewing

the cart in which two items have been added, we can perform

a quick calculation of the tax and shipping costs and view

the total price of all items.

By choosing Canada in the "Country"

drop down menu of the "quick tax and shipping calculation

tool" and pressing the "Calculate" button we

get the final cost of all items including a 3% tax on the

product price and a 3% tax on the shipping cost. Please note

that in the case of Canada the amount of tax applied is the

same for all states since we have not defined state specific

tax rules.

| Figure:

Calculating the tax

and shipping cost for Canada. |

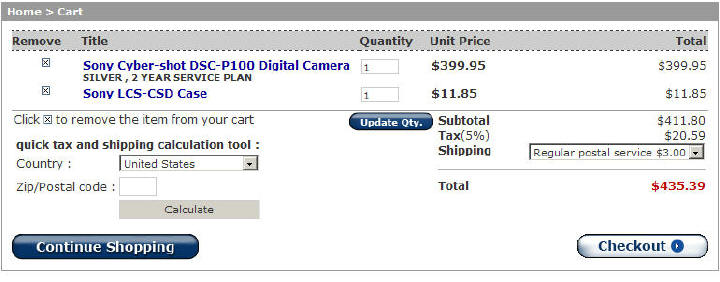

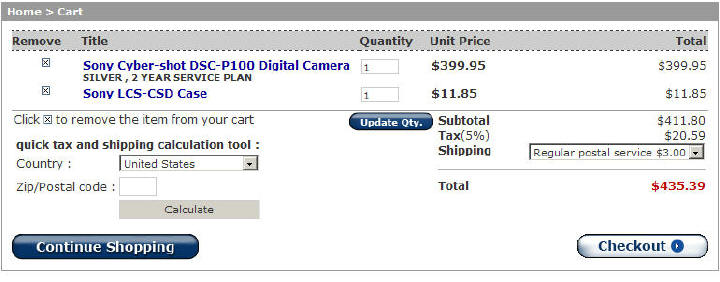

If the United States gets chosen from the

"Country" drop down menu, but no state or zip code

is provided the tax applied on the product price is 5% and

there is no tax on the shipping cost, as define for the United

States in the "Country Tax" form:

| Figure:

Calculating the tax

and shipping cost for the United States. |

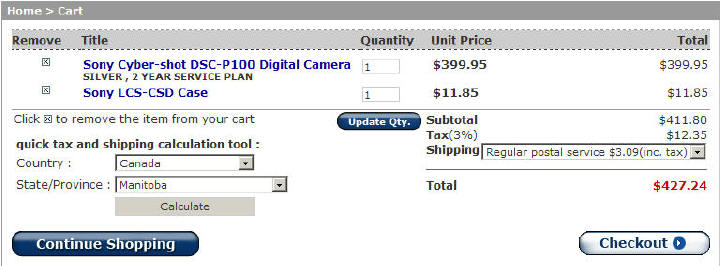

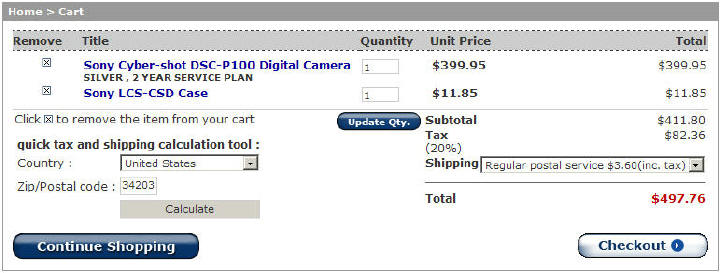

However, if we also provide a zip code

for the United States the appropriate zip (or state) tax rule

fires. In our case, when providing the zip code "34203"

a 20% tax is added to the product price as well as the shipping

price, as explicitly defined in the "Zip Tax" rules.

| Figure:

Calculating the tax

and shipping cost for a specific area -specified by the

Postal Code- in the United States . |

Please note that the Country and Zip code

that a customer defines when using the calculation tool is

not automatically added to the "Billing Details"

and "Shipping Details" forms that are filled in

during the "Checkout" process. And it's the information

in these forms that is actually used for completing the order.

The purpose of the calculation tool is only to inform the

customers about the total cost of an order.

Summary:

Choose "Setup >

Taxes" in the administration panel to set Country or

State specific tax rules. Choose "Setup >

Taxes" in the administration panel to set Country or

State specific tax rules.

To define a Country specific

rule choose the desired Country from the "Country"

drop down menu. To define a State specific one choose the

appropriate State from the "State" drop down menu

or define a Zip code in the "Zip-Prefix" field (zip

code rules only apply to the United States). To define a Country specific

rule choose the desired Country from the "Country"

drop down menu. To define a State specific one choose the

appropriate State from the "State" drop down menu

or define a Zip code in the "Zip-Prefix" field (zip

code rules only apply to the United States).

Define the tax added on

the product price in the "Tax Rate" box. If you

also wish to add tax on the shipping cost tick the "Tax

Shipping" box. Define the tax added on

the product price in the "Tax Rate" box. If you

also wish to add tax on the shipping cost tick the "Tax

Shipping" box.

Finally click on the "Add"

button to save the current rule. Remember, this is important

as the rule will not be applied eitherwise! Finally click on the "Add"

button to save the current rule. Remember, this is important

as the rule will not be applied eitherwise!

Once all the rules have

been defined click the "Update Setup" button to

update the e-commerce storefront with the current settings. Once all the rules have

been defined click the "Update Setup" button to

update the e-commerce storefront with the current settings.

There is always the option

of deleting a rule by use of the "Delete" button. There is always the option

of deleting a rule by use of the "Delete" button.

Remember if you make a mistake, click

the button relating to the section and read through it slowly

to find the problem. When you have found it, highlight it,

change it and click the save button to amend the changes.

If you have any problems please feel free to contact someone

on the live help, or alternatively email [email protected]

for some additional expert help.

|